Use the following information for questions.

Alt Corporation enters into an agreement with Yates Rentals Co.on January 1, 2011 for the purpose of leasing a machine to be used in its manufacturing operations.The following data pertain to the agreement:

(a) The term of the noncancelable lease is 3 years with no renewal option.Payments of $155,213 are due on December 31 of each year.

(b) The fair value of the machine on January 1, 2011, is $400,000.The machine has a remaining economic life of 10 years, with no residual value.The machine reverts to the lessor upon the termination of the lease.

(c) Alt depreciates all machinery it owns on a straight-line basis.

(d) Alt's incremental borrowing rate is 10% per year.Alt does not have knowledge of the 8% implicit rate used by Yates.

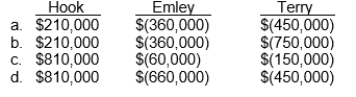

-Hook Company leased equipment to Emley Company on July 1, 2010, for a one-year period expiring June 30, 2011, for $60,000 a month.On July 1, 2011, Hook leased this piece of equipment to Terry Company for a three-year period expiring June 30, 2014, for $75,000 a month.The original cost of the equipment was $4,800,000.The equipment, which has been continually on lease since July 1, 2006, is being depreciated on a straight-line basis over an eight-year period with no residual value.Assuming that both the lease to Emley and the lease to Terry are appropriately recorded as operating leases for accounting purposes, what is the amount of income (expense) before income taxes that each would record as a result of the above facts for the year ended December 31, 2011?

Definitions:

Self-Sabotage

Behavior or thought patterns that hinder personal success or the achievement of goals.

Procrastination

The action of delaying or postponing tasks, often leading to stress, anxiety, and lower productivity.

Hidden Benefits

Advantages or positive outcomes that are not immediately obvious or recognized, often revealing themselves over time or upon deeper analysis.

Workplace Morale

The overall mood of a workplace based on attitudes and satisfaction.

Q11: An option to convert a convertible bond

Q17: The rate of return on ordinary share

Q32: In accounting for a long-term construction-type contract

Q39: What amount of cash was paid on

Q42: If a share dividend occurs after year-end,

Q49: Net cash flow from operating activities for

Q61: What amount of cash was collected from

Q69: Companies recognize a gain or loss on

Q71: International Financial Reporting Standards preceded International Accounting

Q78: Other types of information found in the