Use the following information for questions 94 through 98.

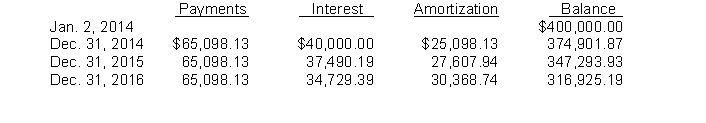

Gage Co. purchases land and constructs a service station and car wash for a total of $360,000. At January 2, 2014, when construction is completed, the facility and land on which it was constructed are sold to a major oil company for $400,000 and immediately leased from the oil company by Gage. Fair value of the land at time of the sale was $40,000. The lease is a 10-year, noncancelable lease. Gage uses straight-line depreciation for its other various business holdings. The economic life of the facility is 15 years with zero salvage value. Title to the facility and land will pass to Gage at termination of the lease. A partial amortization schedule for this lease is as follows:

-From the viewpoint of the lessor, what type of lease is involved above?

Definitions:

Overeating

The consumption of food in quantities greater than what is required by the body, often leading to negative health consequences.

Obesity

Obesity is a medical condition characterized by excessive body fat accumulation, which poses a risk to health, often assessed by measures like the Body Mass Index (BMI).

Heredity

The transmission of traits and characteristics from parent to child by means of genes.

Increased Myelination

The process in neural development where nerve fibers are coated with a protective myelin sheath, improving the speed and efficiency of nerve impulse transmission.

Q9: Why does IASB prohibit retrospective treatment of

Q16: On May 1, 2012, Payne should record

Q33: The IASB requires allocations of joint, common,

Q45: Both a guaranteed and an unguaranteed residual

Q51: Under IFRS,<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3161/.jpg" alt="Under IFRS,

Q51: On January 1, 2011, Ritter Company granted

Q58: Which of the following statements is correct?<br>A)In

Q59: In order to retain certain key executives,

Q67: The amount to be shown on the

Q75: When should an expenditure be recorded as