Use the following information for questions.

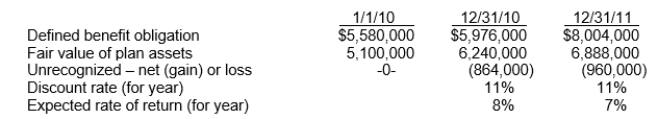

The following information relates to the pension plan for the employees of Turner Co.:

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2011 and benefits paid were $564,000.

-The unexpected gain or loss on plan assets in 2011 is

Definitions:

Operating Segments

Parts of a company that engage in business activities yielding revenues and incurring expenses.

AASB 136 Impairment of Assets

A standard issued by the Australian Accounting Standards Board detailing the procedures for ensuring that assets are carried at no more than their recoverable amount, and how to record any impairment losses.

Impairment Losses

Financial losses recognized when the carrying amount of an asset exceeds its recoverable amount.

Q1: If an IASB standard creates a new

Q18: The statement of cash flows provides information

Q26: A reclassification adjustment is necessary when a

Q46: All of the following statements are true

Q58: Impairments of debt investments are<br>A)based on discounted

Q59: Under the fair value option, companies report

Q70: Judd, Inc., owns 35% of Cosby Corporation.During

Q88: Luther Inc., has 2,000 shares of 6%,

Q89: Based on this information, which test(s) does

Q91: Qualified pension plans permit tax-free status of