Use the following information for questions.

At the beginning of 2012, Pitman Co.purchased an asset for $600,000 with an estimated useful life of 5 years and an estimated residual value of $50,000.For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used.Pitman Co.'s tax rate is 40% for 2012 and all future years.

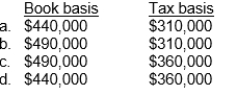

-At the end of 2012, what is the book basis and the tax basis of the asset?

Definitions:

Consent Decrees

Legally binding agreements that resolve disputes between parties without admitting guilt or fault, often used by regulatory agencies to enforce compliance.

Remedial Measures

Actions taken to correct or rectify a problem, often after an error or mistake has been identified.

Nolo Contendere

A legal plea where the defendant does not contest the charge, which is not an admission of guilt but is treated as such for sentencing purposes.

Sentencing Court

A court that has the authority to determine and impose punishment on individuals convicted of crimes.

Q3: Prune Juice Corp.reported the following data on

Q4: Major reasons for disclosure of deferred income

Q10: According to IFRS, once the total compensation

Q26: Spenders Company is an experienced home appliance

Q33: Transfers between categories<br>A)result in companies omitting recognition

Q44: On January 1, 2011 Reese Company granted

Q63: To avoid leased asset capitalization, companies can

Q77: On January 2, 2011, Gold Star Leasing

Q78: When a company decides to switch from

Q100: Harter Company leased machinery to Stine Company