Use the following information for questions.

At the beginning of 2012, Pitman Co.purchased an asset for $600,000 with an estimated useful life of 5 years and an estimated residual value of $50,000.For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used.Pitman Co.'s tax rate is 40% for 2012 and all future years.

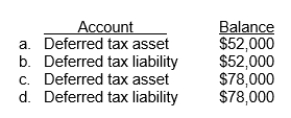

-At the end of 2012, which of the following deferred tax accounts and balances is reported on Pitman's statement of financial position?

Definitions:

Script

A sequence of expected behaviors for a given situation, often acting as a guide for social interaction or task execution.

Restaurant

A business establishment where meals or refreshments may be purchased.

Hierarchical Network Models

Theories suggesting that concepts are represented in the brain in a structured network of relationships, with more general concepts at the top and specific instances beneath.

Classical Approach

usually refers to traditional methods or theories in various fields, relying on established practices and principles that have been validated over time through consistent application and success.

Q8: Cost estimates on a long-term contract may

Q17: On December 31, 2010, Gledhill, Inc.sells production

Q41: Farr, Inc.is a multidivisional corporation which has

Q42: In a multiple-deliverable arrangement, once the separate

Q42: Before the correction was made and before

Q44: Which of the following is correct about

Q56: On April 1, 2012 Weston, Inc.entered into

Q63: Kraft, Inc.sponsors a defined-benefit pension plan.The following

Q95: Which of the following best represents the

Q106: When a corporation sells treasury shares below