Use the following information for questions.

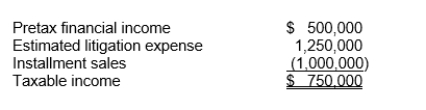

Mathis Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,250,000 will be deductible in 2012 when it is expected to be paid.The gross profit from the installment sales will be realized in the amount of $500,000 in each of the next two years.The estimated liability for litigation is classified as non-current and the installment accounts receivable are classified as $500,000 current and $500,000 noncurrent.The income tax rate is 30% for all years.

-The net deferred tax asset to be recognized is

Definitions:

Q2: Presented below are four segments that have

Q5: On June 30, 2008, Norman Corporation granted

Q7: According to IFRS, a company makes only

Q32: When the lessee agrees to make up

Q35: Presented below is pension information related to

Q38: On a statement of cash flows, additional

Q39: Executory costs include<br>A)maintenance.<br>B)property taxes.<br>C)insurance.<br>D)all of these.

Q58: The rate of return on share capital-equity

Q61: Non-trading equity investments are recorded at fair

Q69: Match the investment accounting approach with the