Use the following information for questions.

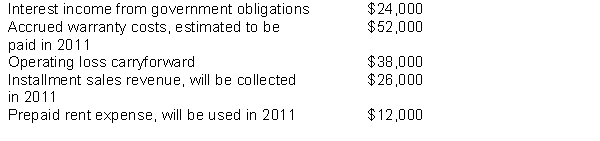

At the beginning of 2010; Elephant, Inc.had a deferred tax asset of $4,000 and a deferred tax liability of $6,000.Pre-tax accounting income for 2010 was $300,000 and the enacted tax rate is 40%.The following items are included in Elephant's pre-tax income:

-What is Elephant, Inc.'s taxable income for 2010?

Definitions:

HRIS System

Human Resource Information System; a software or online solution that manages the data and processes of an organization's human resources department.

Security Issues

Concerns or problems related to the protection of assets, data, and people from threats such as cyber attacks or theft.

Downsizing

The process of reducing an organization's workforce to improve efficiency, reduce costs, or restructure business operations.

Part-timers

Employees who work fewer hours than required for a full-time position, often on a flexible schedule.

Q2: At December 31, 2011, Eilert would report

Q4: On January 1, 2011 (the date of

Q13: Which of the following alternative accounting methods

Q23: In a statement of cash flows, what

Q30: Assuming that Wilcox elects to use the

Q39: When a change in the tax rate

Q40: How should a "gain" from the sale

Q50: At each reporting date, companies adjust debt

Q71: An income statement classification error has no

Q83: In 2012, Sauder should record interest expense