Use the following information for questions.

At the beginning of 2012, Pitman Co.purchased an asset for $600,000 with an estimated useful life of 5 years and an estimated residual value of $50,000.For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used.Pitman Co.'s tax rate is 40% for 2012 and all future years.

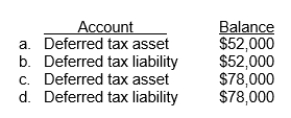

-At the end of 2012, which of the following deferred tax accounts and balances is reported on Pitman's statement of financial position?

Definitions:

Coordinated Thought

The ability to integrate different ideas, perspectives, or pieces of information in a cohesive manner, leading to more complex reasoning and problem-solving skills.

Appetite

A natural desire to satisfy a bodily need, particularly for food.

Myelination

The process of forming a myelin sheath around nerves to increase the speed at which impulses propagate.

Neural Impulses

Electrical signals that travel along the neurons, allowing communication between different parts of the body and the brain.

Q12: Based on this information and rounding all

Q19: All of the following statement are true

Q22: When preparing a statement of cash flows

Q24: Companies classify the balances in the deferred

Q24: Depreciation expense for 2017 was<br>A)$86,000.<br>B)$68,000.<br>C)$18,000.<br>D)$12,000.

Q31: A capitalized leased asset is always depreciated

Q41: If Kiner uses the cost-recovery method, the

Q64: On December 31, 2011 Dean Company changed

Q67: On July 1, 2012, Carsen Company should

Q71: The laws of some jurisdictions require that