Use the following information for questions.

At the beginning of 2012, Pitman Co.purchased an asset for $600,000 with an estimated useful life of 5 years and an estimated residual value of $50,000.For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used.Pitman Co.'s tax rate is 40% for 2012 and all future years.

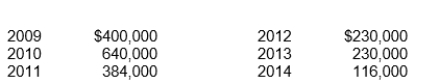

-Lehman Corporation purchased a machine on January 2, 2009, for $2,000,000.The machine has an estimated 5-year life with no residual value.The straight-line method of depreciation is being used for financial statement purposes and the following accelerated depreciation amounts will be deducted for tax purposes:

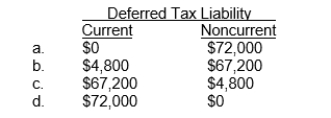

Assuming an income tax rate of 30% for all years, the net deferred tax liability that should be reflected on Lehman's statement of financial position at December 31, 2010, should be

Definitions:

Insurance Coverage

A contractual agreement in which an insurer agrees to compensate or protect an insured party against specified losses or damages in exchange for a premium.

Medical Assistant

A healthcare professional who supports medical practices by performing various administrative and clinical tasks.

Uninsured Children

Refers to minors who do not have health insurance coverage, often impacting their access to healthcare services.

CHIP

Refers to the Children's Health Insurance Program, a government initiative in the United States aimed at providing health coverage to uninsured children in families with incomes too high to qualify for Medicaid but too low to afford private coverage.

Q3: Royce Company holds a portfolio of debt

Q24: When using the discrete view to prepare

Q27: An inventory loss from market decline of

Q38: On a statement of cash flows, additional

Q39: Ophelia Ltd.reported retained earnings at December 31,

Q42: For the year ended December 31, 2012,

Q54: What is the amount that Cooper Enterprises

Q59: In order to retain certain key executives,

Q62: What is the amount of profit on

Q72: The net cash provided (used) by investing