Use the following information for questions.

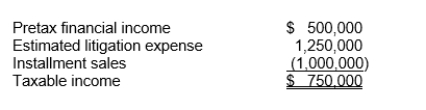

Mathis Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,250,000 will be deductible in 2012 when it is expected to be paid.The gross profit from the installment sales will be realized in the amount of $500,000 in each of the next two years.The estimated liability for litigation is classified as non-current and the installment accounts receivable are classified as $500,000 current and $500,000 noncurrent.The income tax rate is 30% for all years.

-The income tax expense is

Definitions:

Case

An instance or occurrence of a particular situation or example being investigated or examined.

Informed Consent

A process ensuring that a person fully understands the details and implications before agreeing to participate in any procedure or treatment.

Elementary School

An institution for providing child education that comes after preschool and before secondary school, typically for children from the ages of 5 to 11.

Advanced College

An institution of higher education offering undergraduate and postgraduate studies beyond the standard college level.

Q20: At December 31, 2010, Seasons estimates that

Q25: Pisa, Inc.leased equipment from Tower Company under

Q29: Companies account for a change in depreciation

Q31: Over the life of a debt investment,

Q38: Companies must disclose a reconciliation of how

Q57: What is the total net effect of

Q85: Under IFRS companies are required to provide

Q95: What is the price-earnings ratio for Sealy

Q103: If Alt accounts for the lease as

Q104: Alex Company prepares its statement of cash