Use the following information for questions.

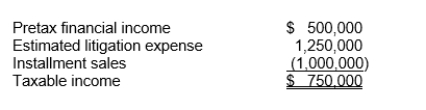

Mathis Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,250,000 will be deductible in 2012 when it is expected to be paid.The gross profit from the installment sales will be realized in the amount of $500,000 in each of the next two years.The estimated liability for litigation is classified as non-current and the installment accounts receivable are classified as $500,000 current and $500,000 noncurrent.The income tax rate is 30% for all years.

-The net deferred tax asset to be recognized is

Definitions:

Uplifts

Positive experiences or occurrences that can improve one's mood and counterbalance stress, enhancing overall well-being.

Hassles

Minor everyday annoyances or problems that, cumulatively, can contribute to stress and affect well-being.

Downturns

Periods or phases characterized by economic decline, reduced activity, or diminished performance.

Distress

A negative emotional state that is a response to stress, characterized by feelings of anxiety, sorrow, or pain.

Q3: Prune Juice Corp.reported the following data on

Q14: All of the following are arguments in

Q16: When using the indirect method to prepare

Q21: When a company holds between 20% and

Q22: Whenever a defined-benefit plan is amended and

Q26: Assuming that income tax payable for 2011

Q28: What did the IASB decide was a

Q36: The corridor for 2011 is<br>A)$619,200.<br>B)$624,000.<br>C)$678,000.<br>D)$800,400.

Q56: The net income for Akira Industries for

Q69: The employees are the beneficiaries of a