Use the following information for questions.

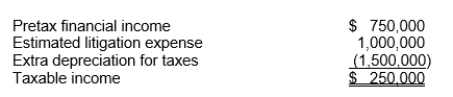

Hopkins Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

-Income tax payable is

Definitions:

Input

Data or signals that are provided to a system or device for processing.

Commands

Instructions or directives given by a user to a computer or software application to perform a specific task or operation.

Messages

Pieces of communication or information conveyed from one person or entity to another.

Processing

The act of performing a series of operations on data or materials to convert them into a desired form or outcome.

Q1: The use of on un realistically low

Q2: From the lessee's viewpoint, an unguaranteed residual

Q6: On January 3, 2010, Moss Co.acquires $100,000

Q9: IFRS requires that all of the following

Q13: Under IFRS deferred tax assets are recognized

Q40: Which of the following should be given

Q52: Liquidating dividends<br>A)Are prohibited under IFRS.<br>B)Require a credit

Q54: On December 1, 2012, Lester Company issued

Q84: A statement of cash flows typically would

Q88: Dawson plc amends its defined pension plan