Use the following information for questions.

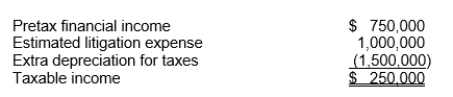

Hopkins Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

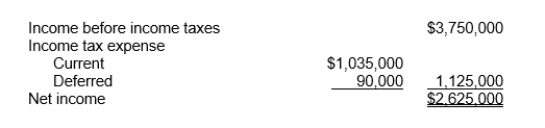

-Eckert Corporation's partial income statement after its first year of operations is as follows:

Eckert uses the straight-line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes.The amount charged to depreciation expense on its books this year was $1,500,000.No other differences existed between book income and taxable income except for the amount of depreciation.Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?

Definitions:

Social Norms

Shared, unspoken rules that govern behavior in society or among members of a particular group, influencing actions and attitudes.

Thomas Szasz

A psychiatrist known for his criticisms of psychiatry and the concept of mental illness.

Medical Model

A framework for explaining illness and disability in purely biological terms and focusing on diagnosis, treatment, and cure.

Medical Model

A framework for understanding diseases and disorders focusing on biological factors and excluding psychological, environmental, and social influences.

Q2: The following information is related to the

Q15: The following information was taken from

Q32: In accounting for a long-term construction-type contract

Q32: Under IFRS, the presumption is that equity

Q33: When a company decides to switch from

Q42: Which of the following is NOT a

Q48: On December 31, 2010, Kessler Company granted

Q50: Litke Corporation issued at a premium of

Q69: The employees are the beneficiaries of a

Q81: The revenue recognition principle indicates that revenue