Use the following information for questions.

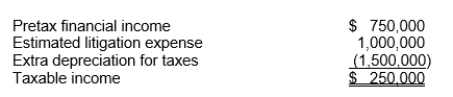

Hopkins Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

-In 2010, Krause Company accrued, for financial statement reporting, estimated losses on disposal of unused plant facilities of $1,500,000.The facilities were sold in March 2011 and a $1,500,000 loss was recognized for tax purposes.Also in 2010, Krause paid $100,000 in fines for violation of environmental regulations.Assuming that the enacted tax rate is 30% in both 2010 and 2011, and that Krause paid $780,000 in income taxes in 2010, the amount reported as net deferred income taxes on Krause's statement of financial position at December 31, 2010, should be a

Definitions:

Financial Resources

The funds used to acquire the natural and human resources needed to provide products; also called capital.

Primary Funding

Primary Funding refers to the initial capital raised by a business or project from various sources such as equity, debt, or grants to finance its startup and initial operations.

Operations

The day-to-day activities involved in managing and controlling the processes of production or provision of services in an organization.

Human Relations Skills

The ability to deal with people, both inside and outside the organization.

Q1: The amortization of Unrecognized Net Loss for

Q7: Which of the following statements is true

Q8: On October 1, 2012, Menke Co.purchased to

Q25: A successful company's major source of cash

Q31: The interest cost for 2011 is<br>A)$537,840.<br>B)$607,200.<br>C)$657,360.<br>D)$880,440.

Q35: A company using a perpetual inventory system

Q35: Problems with interim reporting include<br>A)how to record

Q42: Which of the following is NOT a

Q46: The book value per ordinary share at

Q63: What is the amount of income tax