Use the following information for questions.

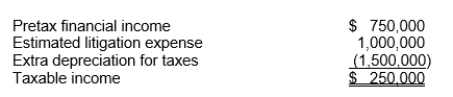

Hopkins Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

-Link Sink Manufacturing has a deferred tax asset account with a balance of $300,000 at the end of 2012 due to a single cumulative temporary difference of $750,000.At the end of 2013, this same temporary difference has increased to a cumulative amount of $1,000,000.Taxable income for 2013 is $1,700,000.The tax rate is 40% for all years.Assuming it's probable that 70% of the deferred tax asset will be realized, what amount will be reported on Link Sink's statement of financial position for the deferred tax asset at December 31, 2013?

Definitions:

Business Combination

A transaction or other event in which an acquirer gains control over one or more businesses, typically through the acquisition of equity interests or assets.

Fair Value

A valuation representing what an asset or liability might sell for in a deal between informed, consenting participants engaged in a fair transaction.

Additional Paid-In Capital

The amount of money shareholders have invested in the company above the nominal value of the shares.

Fair Value

An estimated market price in which an asset would be willingly bought and sold in a transaction between knowledgeable, willing parties.

Q2: IFRS does not allow flexibility regarding the

Q4: Major reasons for disclosure of deferred income

Q20: What is the amount of the deferred

Q26: On January 15, 2017, Truro Corp.paid $240,000

Q27: When a company sells property and then

Q38: When an entity is first transitioning to

Q55: During 2012, Gordon Company issued at 104

Q58: Assume that the 2010 errors were not

Q63: Companies allocate the proceeds received from a

Q98: Differing measures of the pension obligation can