Use the following information for questions.

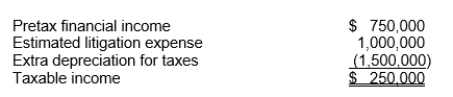

Hopkins Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

-Stephens Company has a deductible temporary difference of $2,000,000 at the end of its first year of operations.Its tax rate is 40 percent.Stephens has $1,800,000 of income taxes payable.At the end of the first year, after a careful review of all available evidence, Stephens determines that it is probable that it will not realize $200,000 of this deferred tax asset.At the end of the second year of operations, Stephens Company determines that it expects to realize $1,850,000 of this deferred tax assets.On Stephens Company's income statement for the second year, what amount of income tax expense will it report related to the temporary difference, and is the amount a debit or credit?

Definitions:

Storage Tank

A large container used for storing liquids, gases, or other substances.

Cognitive Control

The ability of individuals to regulate and manipulate their thoughts, emotions, and actions in pursuit of long-term goals.

Crowded

A situation or environment characterized by high density of people or objects within a given space, often causing discomfort or inconvenience.

Nonrenewable Resources

Natural resources such as coal, oil, and natural gas, that cannot be replenished in a short period of time and will eventually deplete.

Q4: The primary purpose of the statement of

Q4: Which of the following facts concerning property,

Q6: On January 1, 2015, Missoula Corporation bought

Q14: All of the following are arguments in

Q15: Yancey, Inc.would record depreciation expense on this

Q16: Claudius Ltd.sold equipment during calendar 2017 for

Q46: On July 1, 2011, Patton Company should

Q46: When services are delivered by performing more

Q66: Theoretically, in computing the receivables turnover, the

Q84: Mingenback Company has 560,000 shares of $10