Use the following information for questions.

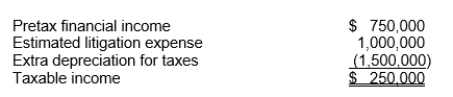

Hopkins Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

-Link Sink Manufacturing has a deferred tax asset account with a balance of $300,000 at the end of 2012 due to a single cumulative temporary difference of $750,000.At the end of 2013, this same temporary difference has increased to a cumulative amount of $1,000,000.Taxable income for 2013 is $1,700,000.The tax rate is 40% for 2013, but enacted tax rates for all future years are 35%.Assuming it's probable that 70% of the deferred tax asset will be realized, what amount will be reported on Link Sink's statement of financial position for the deferred tax asset at December 31, 2013?

Definitions:

Equity

Fairness and justice in the way people are treated, achieved by recognizing and addressing differing needs and circumstances.

Equality

The state of being equal, especially in status, rights, and opportunities; involves the promotion of uniform treatment and absence of discrimination.

Personal Identity

The part of a person’s identity determined by their individual attributes and characteristics.

Social Identity

An individual’s sense of who they are, based on their group membership(s), such as nationality, ethnicity, or religion.

Q12: Amortized cost is the initial recognition amount

Q17: On December 31, 2010, Gledhill, Inc.sells production

Q25: Hiro Corp.issues shares which bear the ultimate

Q32: When the lessee agrees to make up

Q37: Monroe Construction Company uses the percentage-of-completion method

Q44: Which of the following is correct about

Q45: The cost-recovery method recognizes revenue only to

Q49: A reclassification adjustment is reported in the<br>A)income

Q51: For contracts in progress, companies should disclose

Q61: A company uses the equity method to