Use the following information for questions.

Kraft Company made the following journal entry in late 2010 for rent on property it leases to Danford Corporation.

The payment represents rent for the years 2011 and 2012, the period covered by the lease.Kraft Company is a cash basis taxpayer.Kraft has income tax payable of $92,000 at the end of 2010, and its tax rate is 35%.

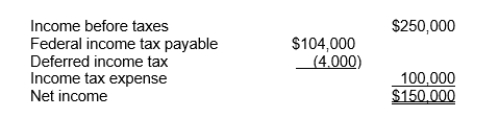

-The following information is available for Kessler Company after its first year of operations:

Kessler estimates its annual warranty expense as a percentage of sales.The amount charged to warranty expense on its books was $95,000.Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?

Definitions:

Immunosuppressive Drugs

Medications used to inhibit or suppress the activity of the immune system, often used in organ transplantation and autoimmune diseases.

Reflex

An automatic and rapid response to a stimulus without conscious thought.

Involuntary Response

Automatic bodily functions or reactions that are not under conscious control, such as reflex actions.

Sensory Neurons

Nerve cells that transmit sensory information (sight, sound, touch, smell, and taste) from the sensory organs to the brain.

Q8: The ratios that reflect financial strength are<br>A)liquidity

Q9: IFRS requires that all of the following

Q22: During 2011, equipment was sold for $156,000.The

Q29: According to IFRS, a segment of a

Q44: When a company adopts a pension plan,

Q47: Mae Jong Corp.issued 1,000 convertible bonds at

Q53: Geary Co.leased a machine to Dains Co.Assume

Q81: When preparing a statement of cash flows,

Q88: Executory costs should be excluded by the

Q96: At January 1, 2012, Trevor Company had