Use the following information for questions.

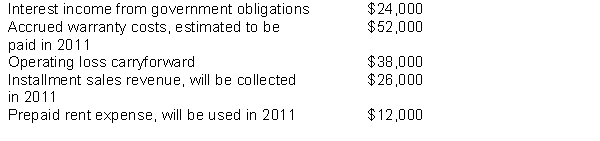

At the beginning of 2010; Elephant, Inc.had a deferred tax asset of $4,000 and a deferred tax liability of $6,000.Pre-tax accounting income for 2010 was $300,000 and the enacted tax rate is 40%.The following items are included in Elephant's pre-tax income:

-The ending balance in Elephant, Inc's deferred tax liability at December 31, 2010 is

Definitions:

Problem-Solving Approach

A systematic process of addressing issues or challenges by identifying the problem, analyzing its causes, generating solutions, and implementing them.

Ombudsperson

A neutral intermediary appointed to investigate complaints and mediate fair settlements between parties, especially in an institutional or organizational setting.

Peer-Review Boards

Committees made up of employees who review decisions or actions (such as disputes or grievances) within an organization, offering a form of internal oversight.

Fast-Track

A process or program designed to speed up employee development or career advancement, often by providing intensive training and opportunities.

Q3: Royce Company holds a portfolio of debt

Q11: An option to convert a convertible bond

Q14: Companies account for transfers of investments between

Q26: Long Co.issued 100,000 shares of $10 par

Q26: Which of the following is NOT considered

Q48: The balance in the Accounts Payable account

Q50: For counterbalancing errors, restatement of comparative financial

Q68: During 2011, a construction company changed from

Q72: The features most frequently associated with preference

Q74: On December 31, 2011, Kuhn Corporation leased