Use the following information for questions.

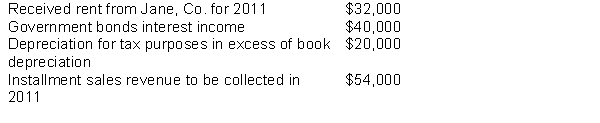

Rowen, Inc.had pre-tax accounting income of $900,000 and a tax rate of 40% in 2010, its first year of operations.During 2010 the company had the following transactions:

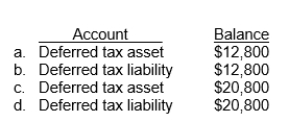

-At the end of 2010, which of the following deferred tax accounts and balances is reported on Rowen, Inc.'s statement of financial position?

Definitions:

American

Pertaining to the United States, its people, culture, or characteristics.

Universal Citizenship

The concept that every person has rights and responsibilities that transcend national boundaries, often associated with global human rights.

Social Citizenship

The rights, protections, and duties that individuals have as members of a society, emphasizing participation and belonging.

Social Movements

Organized collective efforts or campaigns by groups of people to bring about social change or resist social change.

Q10: Palmer Co.had a deferred tax liability balance

Q25: Pisa, Inc.leased equipment from Tower Company under

Q29: Free cash flow is<br>A)the cash flows from

Q33: A company records an unrealized loss on

Q45: Both a guaranteed and an unguaranteed residual

Q57: The deferred tax expense is the<br>A)increase in

Q59: Percy Corporation was organized on January 1,

Q78: A corporation has a defined-benefit plan.A pension

Q80: Cashman Company reported net income of $255,000

Q89: Based on this information, which test(s) does