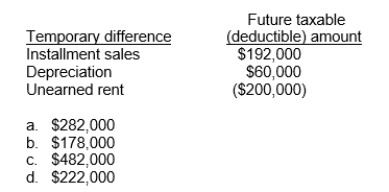

Based on the following information, compute 2011 taxable income for South Co.assuming that its pre-tax accounting income for the year ended December 31, 2011 is $230,000.

Definitions:

Technical Feasibility

An assessment of whether a proposed technology or project can be implemented with existing technical resources and how it can meet the requirements of the project.

Development Expenditures

Costs incurred in the design, implementation, and testing of new products or processes, which may be capitalized or expensed, depending on their nature and future benefit.

Straight-Line Method

A technique for calculating depreciation or amortization that uniformly distributes the cost of an asset across its lifespan.

Depreciation Expense

The allocation of the cost of a tangible fixed asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Q3: Income from an investment in ordinary shares

Q7: On January 1, 2015, Reno Inc.purchased a

Q9: The inventory turnover for 2011 is<br>A)3,200 ÷

Q20: Cash dividends are paid on the basis

Q52: Investments in trading debt investments are generally

Q75: In determining net cash flow from operating

Q77: Gannon Company acquired 6,000 shares of its

Q97: Major reasons why a company may become

Q104: Janae Corporation has outstanding 10,000 shares of

Q106: Declaration of a cash dividend on ordinary