Use the following information for questions.The contract calls for progress billings and payments of $620,000 each quarter.The total contract price is $7,440,000 and Seasons estimates total costs of $7,100,000.Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2010.

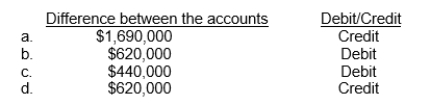

-At December 31, 2011, Seasons Construction estimates that it is 75% complete with the building; however, the estimate of total costs to be incurred has risen to $7,200,000 due to unanticipated price increases.What is reported in the statement of financial position at December 31, 2011 for Seasons as the difference between the Construction in Process and the Billings on Construction in Process accounts, and is it a debit or a credit?

Definitions:

Military-Industrial Complex

The military-industrial complex refers to the close relationship and mutual interests among military leaders, government, and defense contractors, often criticized for promoting military expenditure and involvement in conflicts for profit.

Farewell Address

A statement or speech given by an important figure when leaving office, most famously associated with President George Washington's address in 1796, advising the United States on principles for future security and peace.

Environmental Pollution

The contamination of the natural environment by human activities, leading to harmful effects on living organisms and ecosystems.

GI Bill

A law passed in 1944 that provided a range of benefits for returning World War II veterans, including educational grants, home loan guarantees, and unemployment compensation.

Q9: Clarkson Co.provides the following information about its

Q14: On January 1, 2012, Hood Company sold

Q35: Problems with interim reporting include<br>A)how to record

Q37: In determining the present value of the

Q44: Which of the following is correct about

Q48: On December 31, 2010, Kessler Company granted

Q57: The deferred tax expense is the<br>A)increase in

Q62: Which item is NOT included in amount

Q67: On December 31, 2017, Lewis Ltd.sold a

Q102: Lessors classify and account for all leases