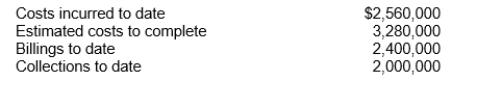

Hiser Builders, Inc.is using the cost-recovery method for a $5,600,000 contract that will take two years to complete.Data at December 31, 2012, the end of the first year, are as follows:

The gross profit or loss that should be recognized for 2012 is

Definitions:

Depreciation Expense

The distribution of a physical asset's cost over its lifespan to account for depreciation or becoming outdated.

Building

A structure with a roof and walls, such as a house, school, or factory, constructed as a place for people to live, work, or carry out activities.

Adjustment

A change made to a financial record to correct or update the information.

Supplies

Items used in the operation of a business that are not directly associated with the products or services being sold, such as office supplies.

Q1: If an IASB standard creates a new

Q4: Share splits and large share dividends have

Q21: What is the amount of the minimum

Q35: The pre-emptive right of an ordinary shareholder

Q39: The conversion of bonds is most commonly

Q45: Callable preference shares permit the corporation at

Q57: If a corporation adhering to IFRS sells

Q77: The relationship between the amount funded and

Q81: Assuming that Sands, Inc.uses straight-line depreciation, what

Q108: The cost method records all transactions in