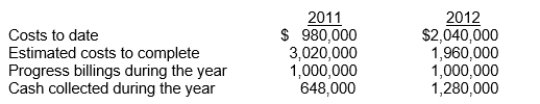

Lark Corp.has a contract to construct a $5,000,000 cruise ship at an estimated cost of $4,000,000.The company will begin construction of the cruise ship in early January 2011 and expects to complete the project sometime in late 2014.Lark Corp.has never constructed a cruise ship before, and the customer has never operated a cruise ship.Due to this and other circumstances, Lark Corp.believes there are inherent hazards in the contract beyond the normal, recurring business risks.Lark Corp.expects to recover all its costs under the contract.During 2011 and 2012, the company has the following activity:

For the year ended December 31, 2012, how much revenue should Lark Corp.recognize on its income statement?

Definitions:

Fully-Funded Pension Funds

Pension plans that have sufficient assets to meet all the pension obligations to participants, both present and anticipated.

Inflation Hedge

An investment that is considered to protect against the decrease in purchasing power due to inflation.

Variable Life Insurance

A type of life insurance where the cash value and death benefit can vary based on the performance of a set of chosen investments.

Tax-Deferred Annuity

A financial product that allows for the investment of pre-tax dollars, where the taxes on earnings are deferred until withdrawal.

Q4: Which of the following is not a

Q7: Macduff Ltd.'s prepaid insurance balance was $10,000

Q17: Which of the following items found in

Q19: Everwood Co.issues 10,000 shares of £10 par

Q21: To two decimals, Pear Corp.'s profit margin

Q36: What amount should be reported in its

Q45: Callable preference shares permit the corporation at

Q50: At each reporting date, companies adjust debt

Q72: A possible source of taxable income that

Q91: The amount of the cash dividend was<br>A)$248,000.<br>B)$328,000.<br>C)$442,000.<br>D)$638,000.