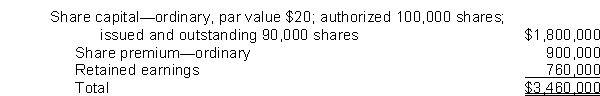

An analysis of equity of Hahn Corporation as of January 1, 2012, is as follows:

Hahn uses the cost method of accounting for treasury shares and during 2010 entered into the following transactions:

Acquired 2,500 of its shares for $75,000.

Sold 2,000 treasury shares at $35 per share.

Sold the remaining treasury shares at $20 per share.

Assuming no other equity transactions occurred during 2012, what should Hahn report at December 31, 2012, as total share premium?

Definitions:

Variable Costs

Costs that vary directly with the level of production or service delivery.

Flexible Budget

A budget designed to adapt in accordance with fluctuations in activity level or volume.

Contribution Margin

The amount by which sales revenue exceeds variable costs of a product, indicating how much contributes to covering fixed costs and generating profit.

Fixed Budget

A budget that is established at the beginning of a period and does not change, regardless of actual performance or outcomes.

Q11: Which of the following is (are)the proper

Q14: Cash dividends are paid on the basis

Q17: On July 1, 2012, Horton Co.purchased Lopez,

Q19: Stephens Company has a deductible temporary difference

Q21: Companies must consider presently enacted changes in

Q22: If a SAR is determined to be

Q23: Frank Corporation has an asset with a

Q32: If management wishes to "capitalize" part of

Q75: Under IFRS, when a barter transaction occurs

Q120: How should cumulative preferred dividends in arrears