Questions are based on the following information.

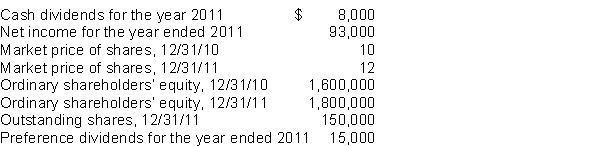

Layne Corporation had the following information in its financial statements for the years ended 2010 and 2011:

-What is the book value per share for Layne Corporation for the year ended 2011?

Definitions:

Basis

The initial value of an asset for tax purposes, used to determine gain or loss on sale or disposition.

Rental Property

Real estate property that is owned by an individual or entity and rented out to tenants in exchange for monthly rental payments.

Recognized Gain

is the portion of a gain that is subject to taxation under the tax laws after the sale or exchange of an asset.

Basis

The original value or cost of an asset or investment for tax purposes, crucial for calculating gain or loss on disposition.

Q16: The payout ratio is determined by dividing

Q22: On July 1, 2012, an interest payment

Q25: On December 31, 2017, Eastern Inc.leased machinery

Q27: What is the rate of return on

Q29: When work to be done and costs

Q30: Subscriptions Receivable are reported as<br>A)a non-current asset.<br>B)a

Q32: Under IFRS, the presumption is that equity

Q33: Raspberry Corp.had the following transactions during the

Q46: The corridor for 2011 was $900,000.The amount

Q69: Companies recognize a gain or loss on