Use the following information for questions.

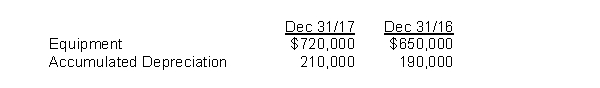

During calendar 2017, Laertes Corp.sold equipment for $70,000.The equipment had cost $100,000 and had a book value of $52,000 at the time of sale.Data from their comparative statements of financial position are:

-Depreciation expense for 2017 was

Definitions:

Early Childhood

A period in a human's life ranging from birth to 8 years old, a critical stage for development and learning.

Memory

The mental capability to store, retain, and recall information from past experiences.

Early Childhood

Early childhood refers to the developmental period ranging from birth to approximately 8 years old, characterized by rapid physical, cognitive, and emotional growth.

Cognitive Development

The process of growth and change in intellectual/mental abilities such as thinking, reasoning, and understanding.

Q30: When the debtor sets aside money in

Q35: Compensation expense resulting from a compensatory stock

Q38: When an entity is first transitioning to

Q38: On December 1, 2012, Abel Corporation exchanged

Q41: An advantage of issuing debt instead of

Q53: Under IFRS, revenue from bill-and-hold sales is

Q54: For the lessor, what is included in

Q56: A difference between IFRS and ASPE's recognition

Q75: During 2017, Khartoum Corp.issued four hundred $1,000

Q91: Which type of dividends do NOT reduce