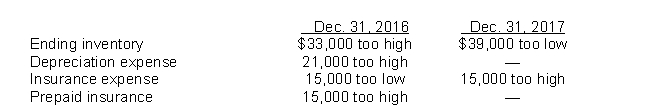

Use the following information for questions.

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors:  In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on Fairfax's retained earnings at December 31, 2017 is that the balance is understated by

Definitions:

Q3: On March 1, 2017, Rabat Corp.sold $300,000

Q6: Accounting issues involved for unincorporated businesses include<br>A)the

Q29: According to IFRS, a segment of a

Q42: Jesse Corp.owns 4,000,000 shares of James Corp.On

Q43: Which of the following pieces of disclosure

Q52: The intrinsic value of the option at

Q53: On a statement of cash flows for

Q54: Presented below is pension information related to

Q57: Diaz should record interest expense for 2020

Q67: On July 1, 2012, Carsen Company should