Use the following information for questions.

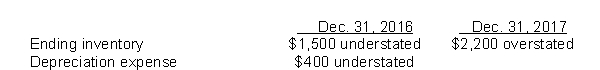

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:  An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

-What is the total net effect of the errors on the amount of Cheyenne's working capital at December 31, 2017?

Definitions:

Family Access

The ability of family members to reach resources, services, or institutions necessary for their welfare.

Single-father Homes

Households in which children live with their father as the sole parent or caregiver.

Single-mother Homes

Households headed by a solo female parent, responsible for the upbringing of her children without a male partner.

Poverty

A state of financial instability where individuals or families lack the means to meet basic needs for food, housing, education, and health care.

Q1: To two decimals, Pear Corp.'s inventory turnover

Q4: A bond's face value is also called<br>A)the

Q4: If Interest Payable were credited when the

Q8: On December 1, 2017, Cairo Ltd.issued 500

Q8: Cost estimates on a long-term contract may

Q10: Executory costs include<br>A)maintenance, interest and property taxes.<br>B)interest,

Q39: Porter Corp.purchased its own par value shares

Q51: Post-employment benefits may include all of the

Q60: Which of the following is not generally

Q79: How should the balances of progress billings