Use the following information for questions.

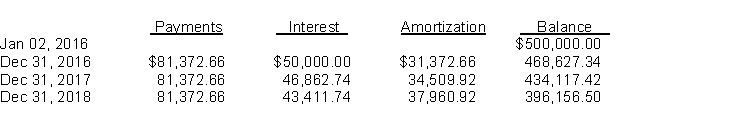

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

-The total lease-related expenses recognized by the lessee during 2017 are (rounded to the nearest dollar)

Definitions:

Ethical Issues

Situations or topics that involve a conflict between moral imperatives, raising questions about what is right or wrong, good or bad.

Public Policy

Governmental laws, regulations, actions, and decisions that are intended to solve public issues and affect citizens' lives.

Individual Decision Making

The process by which a person chooses between alternatives or formulates judgments, based on personal reasoning, preferences, and insights.

Social Issue

Refers to problems that affect many people within a society, often requiring community action for resolution.

Q1: Under IFRS, a company<br>A)Should evaluate every investment

Q4: Share splits and large share dividends have

Q12: Amortized cost is the initial recognition amount

Q22: When preparing a statement of cash flows

Q37: An investment in marketable securities was distributed

Q40: A franchise agreement grants the franchisor an

Q46: On July 1, 2011, Patton Company should

Q48: How should long-term debt be reported if

Q63: An advantage of the immediate recognition approach

Q63: Companies allocate the proceeds received from a