Use the following information for questions.

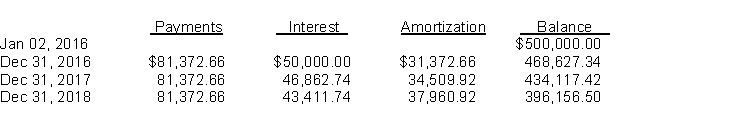

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

-What is the amount of the lessee's obligation to the lessor after the December 31, 2018 payment? (Round to the nearest dollar.)

Definitions:

Activation

The process of making something active or operative, especially in the context of biological and psychological mechanisms.

Living Brain

Refers to the functioning brain as it operates within a living organism, emphasizing its active processes and capabilities.

Skull

The bony structure that forms the head in vertebrates, housing and protecting the brain.

Techniques

Methods or strategies used to accomplish a specific task or solve a particular problem.

Q17: Which of the following statements is correct?<br>A)Options

Q18: Glavine Company issues 6,000 shares of its

Q21: Mae Jong Corp issues $1,000,000 of 10%

Q34: The cash used in investing activities in

Q34: In which order of preference are a

Q43: The debt to total assets ratio is

Q62: On December 31, 2010, Houser Company granted

Q67: "Gains" on sales of treasury (using the

Q70: Judd, Inc., owns 35% of Cosby Corporation.During

Q78: Hiser Builders, Inc.is using the cost-recovery method