Use the following information for questions.

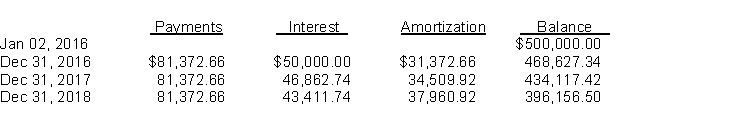

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

-The total lease-related income recognized by the lessee during 2017 is

Definitions:

Ducts

Tubes, channels, or passages in the body or in a machine that convey fluid or air from one location to another.

Interstitial Fluid

Fluid that surrounds the body’s cells; consists of dissolved substances that leave the blood capillaries by filtration and diffusion.

Metabolism

The set of life-sustaining chemical reactions in organisms to convert food into energy, and build or maintain their cells.

First Messenger

Chemical signal, such as a peptide hormone, that binds to a plasma membrane receptor protein and alters the metabolism of a cell because a second messenger is activated.

Q7: Derivative instruments<br>A)require significant investments.<br>B)transfer financial risks.<br>C)transfer primary

Q9: Direct incremental costs incurred to sell shares

Q13: Which of the following is NOT a

Q14: Which of the following best describes a

Q16: Companies measure debt investments at fair value

Q37: Under IFRS, a convertible debt security is

Q49: For a sales-type lease (ASPE)or manufacturer or

Q59: Rounded to the nearest dollar, the amount

Q67: Safe Skies Travel sells airplane tickets for

Q121: Assuming that $21,000 will be distributed as