Use the following information for questions.

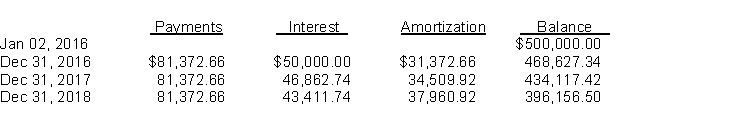

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

-The total lease-related expenses recognized by the lessee during 2017 are (rounded to the nearest dollar)

Definitions:

Revenue

The total amount of money generated by a company from its business activities, such as sales of goods or services, before any expenses are deducted.

Salaries Payable

A liability account that records the amounts of wages earned by employees that have not yet been paid to them.

Salaries Expense

An accounting item that represents the total amount paid to employees in the form of salaries over a specific period of time.

Adjusting Entry

A journal entry made in accounting records at the end of an accounting period to allocate income and expenditures to the period in which they actually occurred.

Q16: Companies measure debt investments at fair value

Q26: The reverse treasury stock method is used

Q40: On January 2, 2017, Helisinki Ltd.issued at

Q41: On May 1, 2012, Payne should credit

Q43: At the beginning of 2011, Flaherty Company

Q62: The proper accounting for the costs incurred

Q64: Hedge accounting is<br>A)mandatory.<br>B)mandatory if specified criteria are

Q70: Regarding zero-interest-bearing notes,<br>A)they do not have an

Q77: Occasionally a franchise agreement grants the franchisee

Q102: Which of the following statements about property