Use the following information for questions.

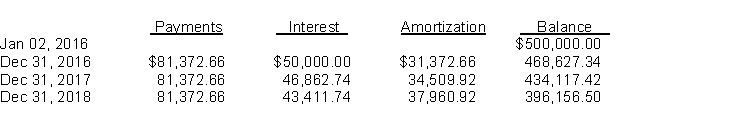

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

-The total lease-related income recognized by the lessee during 2017 is

Definitions:

Job Searching

The process of actively seeking new employment opportunities through various means such as online job boards, networking, and applying to companies.

A social networking platform that allows users to post short messages, known as tweets, to share information, news, or personal updates.

User Criticisms

Feedback from users expressing dissatisfaction or problems they have encountered with a product or service.

Brand Buzz

The conversation and excitement surrounding a brand, often measured by social media mentions, reviews, and overall public sentiment.

Q1: Hayes Construction Corporation contracted to construct a

Q2: At December 31, 2016, Felix Ltd.had 500,000

Q20: At December 31, 2010, Seasons estimates that

Q24: When using the discrete view to prepare

Q29: According to the Exposure Draft of Proposed

Q31: The present value of the interest is<br>A)$172,410.<br>B)$174,780.<br>C)$186,300.<br>D)$188,415.

Q46: Under ASPE, if land is the sole

Q64: When an issuer offers some form of

Q77: Gannon Company acquired 6,000 shares of its

Q83: Hiro Corp.issues 1,000 €5 par value ordinary