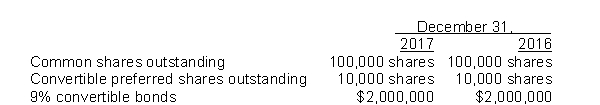

Information concerning the capital structure of Shelmardine Corporation follows  During 2017, Shelmardine paid dividends of $1.00 per common share and $2.50 per preferred share.The preferred shares are non-cumulative, and convertible into 20,000 common shares.The 9% convertible bonds are convertible into 50,000 common shares.Net income for calendar 2017 was $500,000.Assume the income tax rate is 30%.

During 2017, Shelmardine paid dividends of $1.00 per common share and $2.50 per preferred share.The preferred shares are non-cumulative, and convertible into 20,000 common shares.The 9% convertible bonds are convertible into 50,000 common shares.Net income for calendar 2017 was $500,000.Assume the income tax rate is 30%.

What is the diluted earnings per share for 2017?

Definitions:

Bar Exam

A comprehensive examination that law graduates must pass in order to practice law in a specific jurisdiction or state.

License

Official permission or permit allowing the holder to do, use, or own something within legal bounds.

Nondisclosure Agreement

A legal contract between at least two parties that outlines confidential material, knowledge, or information that the parties wish to share with one another for certain purposes but wishes to restrict access to or by third parties.

Usurious Agreement

A loan agreement that charges interest rates above the legal limit, considered exploitative.

Q4: On January 1, 2011 (the date of

Q16: An entry for dividends is NOT made

Q31: On December 31, 2017, Street Ltd.has $2,000,000

Q33: Which of the following statements is true?<br>A)Refinanced

Q35: Presented below is information related to Peach

Q35: Aluminum Ltd.has made a total of $23,250

Q39: Ophelia Ltd.reported retained earnings at December 31,

Q43: Vilnius Corporation has 100,000 no par value

Q54: On January 1, 2017, Seal Corp.purchased a

Q108: The cost method records all transactions in