Use the following information for questions.

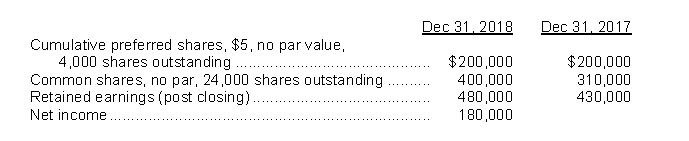

The following data are provided for Croatia Corp.'s last two fiscal years:  Additional information:

Additional information:

On May 1, 2018, 6,000 common shares were issued.Although dividends had been declared regularly up to December 31, 2017, preferred dividends were NOT declared during 2018.The market price of the common shares was $100 at December 31, 2018.

-The book value per common share at December 31, 2018 is

Definitions:

Payment In Full

The complete settlement of an obligation, such as paying off a loan or a bill, without any remaining balance.

Contractors

Individuals or organizations contracted to perform specific tasks or services for a defined period under agreed terms.

Amortized Loan

A loan with scheduled periodic payments that consist of both principal and interest.

Pure Discount

A financial instrument, such as a zero-coupon bond, that is sold at a discount and pays no interest, only returning the face value at maturity.

Q5: Lee Kim Inc.'s most recent statement of

Q5: In calculating diluted earnings per share, the

Q6: Under IFRS, common shares are also called<br>A)ordinary

Q9: Information concerning the capital structure of Shepherd

Q16: An entry for dividends is NOT made

Q19: Mardaloop Inc.is developing a new process which

Q22: Retrospective application is required for all<br>A)errors and

Q30: Monkey Shines Ltd., a Canadian public corporation,

Q32: Under ASPE, which of the following statements

Q44: Madrigal Corp.sold its headquarters building at a