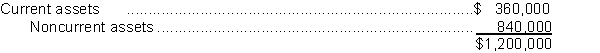

During 2017, Spokane Ltd.purchased the net assets of Tacoma Corp.for $635,000.On the date of the transaction, Tacoma reported $200,000 in liabilities.As well, the fair value of Tacoma's assets were:  How should the difference between the fair value of the net assets acquired and the cost be accounted for by Spokane?

How should the difference between the fair value of the net assets acquired and the cost be accounted for by Spokane?

Definitions:

Single

A filing status for unmarried taxpayers who do not qualify for any other filing status on their tax return.

American Opportunity Tax Credit

A refund for allowable educational fees paid for a qualifying scholar during their first four years of advanced education.

Qualifying Expenses

Specific expenses that meet criteria set by tax laws or other regulations for deduction or special treatment.

AGI

Adjusted Gross Income, calculated by taking gross income and subtracting specific deductions. It's used to determine taxable income and eligibility for certain tax credits and deductions.

Q3: On March 1, 2017, Rabat Corp.sold $300,000

Q9: Assuming Tarantula always takes the maximum CCA,

Q11: The following information pertains to Rembrandt Inc.'s

Q13: The times interest earned ratio measures<br>A)the amount

Q20: The net method of recording accounts receivable

Q41: Which of the following is a required

Q50: Cupcake Corp.has sold goods at terms 2/10,

Q51: During 2017, Brandon Inc.purchased 2,000, $1,000, 9%

Q67: According to the IASB current proposed definition,

Q78: Red Corp.should report investment revenue for 2017