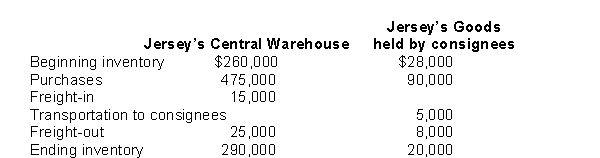

The following information was derived from the 2017 accounting records of Jersey Co.:  Jersey's 2017 cost of sales was

Jersey's 2017 cost of sales was

Definitions:

Income Tax Schedule

A chart or table displaying the rates to be applied to income ranges for calculating the amount of income tax due.

Taxable Income

The portion of an individual's or entity's income used as the base for calculating income tax owed to the government.

Average Tax Rate

The ratio of the total amount of taxes paid to the total income, indicating how much of one's income goes to taxes.

Income Tax Schedule

A chart or table that displays tax rates applied to different levels of taxable income, used to calculate the amount of income tax owed.

Q1: Under the completed-contract method,<br>A)revenue, costs, and gross

Q5: On July 1, 2017, Buffalo Corporation purchased

Q13: When one corporation has control over another

Q19: Asbestos Corp.is being sued for illness caused

Q29: Intangible assets that have a finite life

Q40: Which of the following best describes the

Q57: Under IFRS, a provision is<br>A)a special fund

Q60: Diaz should recognize a gain on the

Q79: A project was correctly accounted for under

Q104: Assume that no correcting entries were made