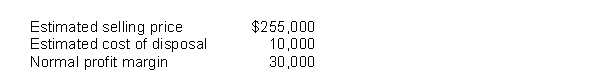

Washington Distribution Co.has determined its December 31, 2017 inventory on a FIFO basis at $240,000.Information pertaining to that inventory follows:  Washington records losses that result from applying the lower of cost and net realizable value rule.At December 31, 2017, the loss that Washington should recognize is

Washington records losses that result from applying the lower of cost and net realizable value rule.At December 31, 2017, the loss that Washington should recognize is

Definitions:

Fee

A charge for services provided or the right to participate in an activity or access certain benefits.

Unearned Rent Revenue

Liability account that reflects payments received for rent before the rental period has occurred; it is recognized as revenue over time as the service is provided.

Rent Expense

The cost incurred by a business to utilize property as an office, manufacturing space, storage, or retail location.

Prepaid Rent Expense

An asset account that shows the amount of rent paid in advance, which has not yet been consumed or used.

Q8: Making and collecting loans and disposing of

Q16: When an investor, using the equity method,

Q35: Which of the following is INCORRECT regarding

Q36: On July 1, 2017, Tilapia Corp.had outstanding

Q44: If the beginning 2017 balance in the

Q53: Rathbone Corp.sells major household appliance service contracts

Q62: The journal entries related to a bank

Q64: The operating cycle is the time between<br>A)selling

Q71: If Thunder Bay acquired a 30% interest

Q95: When a public company holds between 20%