Use the following information for questions.

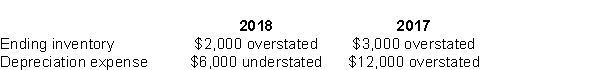

Giselle Ltd.is a calendar-year corporation.Its financial statements for the years 2018 and 2017 contained errors as follows:

-Assume that no correcting entries were made at December 31, 2017, or December 31, 2018 and that no additional errors occurred in 2016.Ignoring income taxes, by how much will working capital, at December 31, 2016 be overstated or understated?

Definitions:

Unsecured Debts

Financial obligations that are not backed by collateral, making them riskier for lenders and potentially resulting in higher interest rates for borrowers.

Maturities

The dates on which financial obligations or debt instruments (such as bonds, loans, or other forms of securities) are due to be paid off.

Unfunded Liabilities

Obligations for which sufficient assets have not been set aside and are not currently funded by investment.

Notes

Short for promissory notes, these are debt instruments whereby one party promises in writing to pay a determinate sum of money to the other at a specified date or upon demand.

Q2: Which of the following should be shown

Q3: Financial accounting can be broadly defined as

Q27: Blueberry Inc.reported the following information for 2017:

Q28: A fair value measure under IFRS 13

Q41: In the absence of specific GAAP guidance,

Q50: Working capital is<br>A)capital which has been reinvested

Q52: A local businessman owns several different companies.His

Q53: Rathbone Corp.sells major household appliance service contracts

Q56: Which of the following is considered as

Q123: The 2017 financial statements of Barclay Ltd.reported