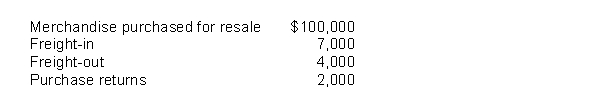

The following information was reported by Montana Inc.for 2017:  Based on this data, Montana's 2017 inventoriable cost was

Based on this data, Montana's 2017 inventoriable cost was

Definitions:

Financial Burden

A financial burden is a substantial monetary load that may come in the form of debt, high costs, or other financial obligations that affect an individual's or entity's budget or financial well-being.

Average Tax Rate

The ratio of the total amount of taxes paid to the total income earned, representing the percentage of income paid in taxes.

Taxable Income

The portion of an individual's or corporation's income that is subject to taxes according to federal, state, or local law.

Lump-Sum Tax

A tax that is a fixed amount, regardless of the tax base's changes in size or value.

Q1: Which of the following is an internal

Q1: Which of the following is NOT a

Q2: In a periodic inventory system, if the

Q12: Which of the following is NOT a

Q13: Which of the following statements is correct?<br>A)There

Q16: If a trademark is developed by the

Q20: On January 1, 2017, Linen Corp.issued $450,000

Q41: On Dec 12, 2017, Ivory Coast, CGA,

Q45: Which of the following should NOT be

Q78: Red Corp.should report investment revenue for 2017