Use the following information to answers questions

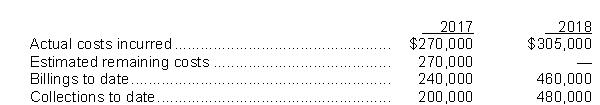

During 2017, Indie Corp.started a construction job with a total contract price of $700,000.Indie has consistently used the completed contract method.The job was completed on December 15, 2017.Additional data are as follows:

-For 2015, what amount should Horn recognize as gross profit?

Definitions:

Approach-Avoidance Conflict

A psychological struggle occurring when a goal is both appealing and disconcerting to an individual.

Approach-Approach Conflict

A psychological dilemma occurring when an individual must choose between two desirable outcomes.

Avoidance-Avoidance Conflict

A situation where a person must choose between two equally unattractive options or outcomes.

Joint Decisions

The process of making decisions collaboratively among two or more parties or stakeholders, often involving negotiation or consensus-building.

Q3: Under IFRS, end of the period adjustments

Q6: Which of the following is a change

Q13: A machine has a cost of $24,000,

Q18: On January 2, 2017, Congo Delivery Company

Q19: The general accounting standards for recognition and

Q44: King Inc.incurred the following infrequent losses during

Q56: The fair value model of accounting for

Q71: Goods in transit which are shipped FOB

Q72: Losses on unprofitable long-term construction projects<br>A)are generally

Q85: Fred received merchandise on consignment from Dino.As