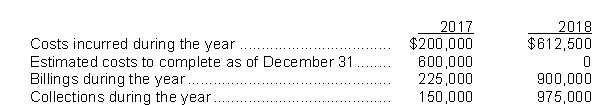

Use the following information for questions.

Alternative Ltd.Began work in 2017 on a contract for $1,200,000.Other details follow:

-Assume that Alternative uses the completed-contract method of accounting.The portion of the total gross profit to be recognized in 2018 is

Definitions:

Q7: Where there are potentially multiple performance obligations

Q19: T purchased a 60 percent interest in

Q20: An accrual basis partnership may deduct interest

Q23: When using a periodic inventory system,<br>A)a Purchases

Q23: During the current year, Taxpayer Q quits

Q27: W sold an automobile that had been

Q41: Compared to the accrual basis of accounting,

Q47: Which of the following is NOT a

Q62: Which of the following statements is correct?<br>A)IFRS

Q63: At the end of its accounting year,