Use the following information to answers questions

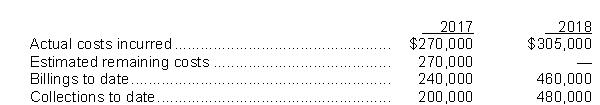

During 2017, Indie Corp.started a construction job with a total contract price of $700,000.Indie has consistently used the completed contract method.The job was completed on December 15, 2017.Additional data are as follows:

-For 2015, what amount should Horn recognize as gross profit?

Definitions:

Belt-Driven Fan

A fan driven by a belt connected to the engine, primarily used to cool the engine by forcing air over the radiator.

Electric Fan

A fan powered by electricity, used in various applications including cooling systems in vehicles, computers, and as a household appliance for air circulation.

Trapped Air

Air that has become confined within a system or component, often causing operational inefficiency or malfunction.

Cooling System

The system that removes excess heat from an engine and provides heat for the passenger compartment. Components include the coolant, radiator, radiator cap, radiator fan, water jackets, thermostat, hoses, and heater core.

Q4: Under the allowance method of recognizing uncollectible

Q4: Qualified retirement plans may be funded or

Q13: Under ASPE, Other Comprehensive Income (OCI)and Accumulated

Q35: Interperiod tax allocation causes<br>A)the income tax expense

Q38: Under IFRS, bearer plants used to grow

Q43: Which of the following items would be

Q46: On December 31, 2017, Flint Corporation sold

Q48: Under ASPE, when work to be done

Q74: When a zero-interest-bearing note is issued, its

Q119: An inventory cost formula in which the