Use the following information for questions.

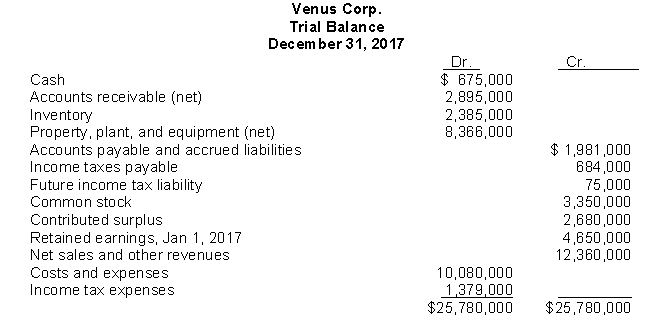

Venus Corp.'s trial balance at December 31, 2017 is properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2017:

Other financial data for the year ended December 31, 2017:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2019.

The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.The current and future tax rate on all types of income is 35 percent.

-In Venus's December 31, 2017 statement of financial position, the final retained earnings balance is

Definitions:

Q6: Which of the following is a change

Q37: Which of the following does NOT correctly

Q37: Financial reporting is<br>A)independent of the environment in

Q45: In a statement of cash flows, proceeds

Q62: On June 1, 2017, Carr Corp.loaned Farr

Q63: White Resources determines that it has NOT

Q76: The principal disadvantage of using the percentage-of-completion

Q79: Accounting of impairment losses is required for

Q79: A project was correctly accounted for under

Q121: Which of the following items should be