Use the following information for questions.

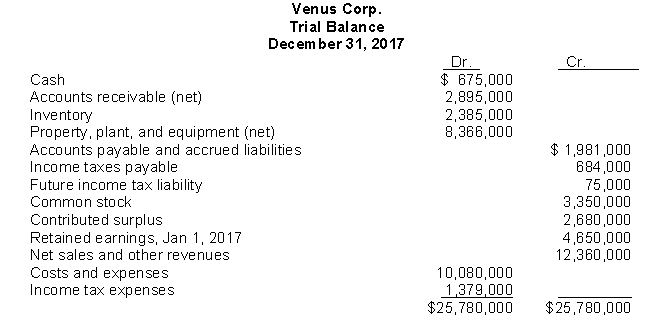

Venus Corp.'s trial balance at December 31, 2017 is properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2017:

Other financial data for the year ended December 31, 2017:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2019.

The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.The current and future tax rate on all types of income is 35 percent.

-In Venus's December 31, 2017 statement of financial position, the current liabilities total is

Definitions:

Conduct Business

The act of engaging in activities that involve the sale or purchase of goods and services with the aim of earning profits.

Pocahontas

A Native American woman notable for her association with the colonial settlement at Jamestown, Virginia, and her role in fostering peace between English colonists and Native Americans.

John Smith

John Smith was an English soldier, explorer, and author, best known for his role in establishing the first permanent English settlement in North America at Jamestown, Virginia, and his interactions with the Native American population.

Q12: Saucy Inc. reported a taxable and accounting

Q32: Amazing Company acquires a trade name from

Q50: One objective of interperiod tax allocation is

Q50: Land was purchased to be used as

Q50: Control of an asset normally coincides with<br>A)transfer

Q52: A local businessman owns several different companies.His

Q53: Which of the following is NOT a

Q56: How much cash was collected in 2014

Q83: The following information is available for Figment

Q99: The ending inventory on a FIFO basis