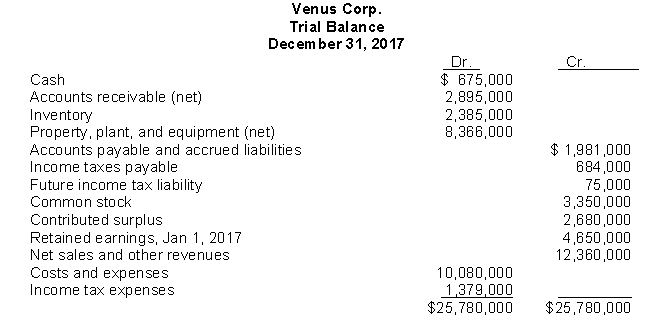

Use the following information for questions.

Venus Corp.'s trial balance at December 31, 2017 is properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2017:

Other financial data for the year ended December 31, 2017:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2019.

The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.The current and future tax rate on all types of income is 35 percent.

-In Venus's December 31, 2017 statement of financial position, the final retained earnings balance is

Definitions:

Slut-bashers

Individuals who engage in slut-shaming, a practice of criticizing and stigmatizing people, typically women, for their real or presumed sexual activity.

Players

Individuals or entities actively involved in a particular field or activity, especially within competitive contexts.

Heterosexism

The belief or assumption that heterosexuality is the only natural, normal, or superior sexual orientation, leading to discrimination against non-heterosexual orientations.

Sex Education

Teaching about human sexuality, including aspects of relationships, reproductive health, and sexual behavior.

Q18: On January 2, 2017, Congo Delivery Company

Q18: Under § 401, contributions made as part

Q22: In preparing its August 31 bank reconciliation,

Q30: Which of the following is not a

Q34: Under IFRS, equity does NOT include<br>A)long term

Q41: In the absence of specific GAAP guidance,

Q42: At January 1, 2017, Nevada Ltd.had 150

Q45: Limitations of the income statement include all

Q50: The gross profit percentage is calculated by<br>A)dividing

Q57: Other comprehensive income does NOT include<br>A)comprehensive income.<br>B)net