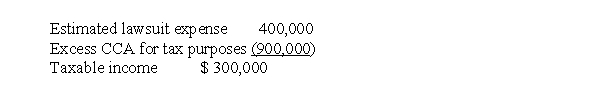

At the end of 2017, its first year of operations, Halifax Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Halifax adheres to IFRS requirements. The deferred tax liability to be recorded is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Halifax adheres to IFRS requirements. The deferred tax liability to be recorded is

Definitions:

Direct Labor-Hours

The total hours of labor directly involved in the production of goods.

Activity-Based Costing

A costing methodology that assigns overhead and indirect costs to specific products or services based on the activities that contribute to these costs.

Overhead

The indirect costs of running a business that cannot be directly linked to a specific product or service, such as utilities, rent, and administrative expenses.

Activity Rate

The predetermined overhead rate used in activity-based costing to assign overhead costs to products or services based on a specific activity.

Q8: Cookie Ltd.receives a four-year, $100,000 zero-interest-bearing note.The

Q17: Oxbow LLC develops apartment complexes all around

Q28: The problem of information asymmetry can be

Q29: The at-risk rules generally do not operate

Q31: For many years, T Corporation accounted for

Q37: During the current year, F, an individual,

Q40: Using IFRS, IAS 12 guidelines allow for

Q46: The earned income credit is the same

Q53: A deferred tax liability is the<br>A)current tax

Q57: Which one of the following expenses does