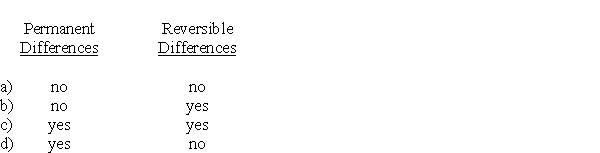

When calculating income tax expense, taxable income of a corporation differs from pre-tax accounting income because of

Definitions:

Excise Tax

A tax imposed on specific goods, services, or activities, usually with the aim of reducing consumption or generating revenue.

Pretax Level

A financial figure or income amount before any taxes have been deducted.

Excise Tax

A tax levied on specific goods, services, or transactions, often used to discourage their use or raise revenue.

Shift

A change in position, direction, or tendency, often referring to movements in supply or demand curves in economics.

Q1: Which of the following is an internal

Q11: Which of the following sources of generally

Q26: On May 15, 2017, Grey Corp.purchased 1,000

Q38: A taxpayer who is 60 years old

Q40: L is the sole shareholder and an

Q46: Which of the following is NOT an

Q51: Burton Ltd.operates in both Canada and the

Q55: When a vendor is exposed to continued

Q56: How much cash was collected in 2014

Q60: The adjusted basis of purchased property is<br>A)Equal