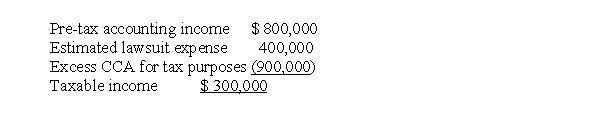

At the end of 2017, its first year of operations, Kali Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

Definitions:

Behavioral Segmentation

The process of dividing consumers into groups based on their observed behaviors, such as purchasing habits, brand interactions, and product usage.

Behavioral

Pertaining to the actions or reactions of individuals or systems in response to external or internal stimuli, often studied in psychology and marketing.

Demographic

Statistical data relating to the population and particular groups within it, often used for identifying target markets.

Geographic

Pertaining to the study or organization of the Earth's surface and its features or relating to the natural land formations of regions.

Q5: In preparing its bank reconciliation for the

Q15: As of 2011, the responsibilities of the

Q18: Dr.S has done extremely well financially.Several years

Q20: Y exchanges a rent house, which he

Q35: The basis for classifying assets as current

Q40: H sold a parcel of real estate

Q41: Compared to the accrual basis of accounting,

Q55: Fraudulent financial reporting is a business reality.While

Q59: Cost estimates at the end of the

Q66: In order to measure fair value under